Payslip Format Word Download Pay Slip

This slip in Excel format can be used to manage the monthly salary record paid to the employees. Salary slips are short but very important documents, since these are the record of the salary of any employee which holds the details of all the payments which are done to the employee.Salary Payslip Template Excel Excel Details: 22 Free Salary Slip Templates - Word Excel Templates.Excel Details: Salary Slip Template 08. Here is download link for this Salary Slip Template created using MS Word, Download Pay Slip / Salary Slip Template. Here is another Salary Slip Template.

A Salary Slip is a certificate handed out by an employer to his/her employees when they are given their salaries. In this article, we will be covering the following topics.Porn images Salary Slip Excel Templates, and pay slip template payroll template word template excel, template editable payslip precautions you must take.Updated on AugBy admin Leave a comment. However, the importance of a salary slip is often overlooked, and the need to understand how to read and create a salary slip is ignored. Whether it’s an office or business, a school, college or university, some construction site or medical center, you need payslips everywhere to keep a record of the payment of wage.Salary slips are just as valuable as any other written proof is – investment documents or purchase invoices. Payslips are required in every organization. (Oh, the sweet sound of that morning SMS.) And, salary slip is the written or printed document entailing the details of your salary.The payslip templates are some of the most used templates for all the good reasons.

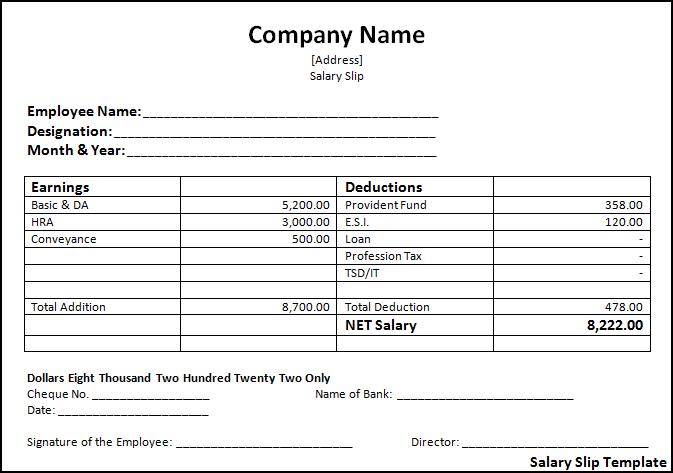

This document can either be printed out and given to the employees or mailed to them. A salary slip can be defined as a document issued by an employer to its employees, containing the detailed breakdown of an employee’s earnings and deductions for a given month. Editable Payslip Template Keywords: DAEIHiunOww,BACrKZxYL2I. Employee Name:Gender:John WidsMalePaid Days:LOP Days:300. What are the components of a salary slip?PaySlip for the Month of August 2020. And finally net amount paid to the employee.

Your employees will also need their salary slip if they want to avail a credit card or financial loan. The salary slip contains the break-up of your employee’s salary which can help them understand their take-home salary, taxes paid to the government and forced savings such as PF and ESI. Here are 4 major reasons salary slips are important. And, it is your responsibility to ensure salary slips are generated and sent to employees every month. Why Are Salary Slips Important?Salary slips are important for your employees for a variety of reasons.

Earnings/IncomesThe earnings or incomes record the salary being earned and any other allowances, bonuses or gains that form an employees income. Admission cells and recruiters require salary slips to validate the claims made by your employees.What Are The Components Of A Salary Slip?Any salary slip has two major components: earnings/incomes and deductions. Salary slips also play a critical role in your employee’s background verification when changing jobs or applying for higher studies. Providing your employees with a salary slip can help them better negotiate salary with prospective employers. While you wouldn’t want your employees to leave, it’s a harsh reality that they eventually will.

Dearness Allowance (DA) was introduced by the government to help employee reduce the impact of inflation and is often 5% of your employee’s basic salary. And, it is the basic salary that is used to calculate DA, PF & ESI contributions. Basic Salary forms the most essential component, making up 35-40% of your entire salary.

Provident Fund (PF) is calculated at 12% of the basic salary + DA and both, employee and employer must contribute 6% towards PF. The major components appearing under deductions are: Other Allowance cover reimbursement of other miscellaneous costs that the employee had to bear during the term of the employment like the phone bill.Deduction components are those components that are mandatorily deducted from an employees salary towards taxes – TDS and PT – and forced savings – PF and ESI. Performance Bonus and Special Allowance is primarily the final component that is added to the salary structure after all other components have been exhausted. Medical Allowance (MA) is the reimbursement of medical expenses employee had to bear during the term of employment.

Payroll software can be of tremendous value to your organization by reducing the time required to process monthly payroll and automatically generates employee payslip. In the template just add your organization’s details, employee details, and a few other details, and all other calculations will be taken care of.However, there is a simpler way for you to generate your employee payslip, by using payroll software. Tax Deduction at Source (TDS) is the tax deduction by the employer on behalf of the Income Tax Department from employee’s salary based on the tax slab of the employee.Just click on the button below to download the salary slip template for your organization. Professional Tax (PT) is a state tax that salaried employees need to pay and varies from one state to another. ESI is mandatory for all organization with 20+ employees and is a mandatory deduction for employees whose gross salary is less than INR 21,000. Employee State Insurance (ESI) contributions are made by the employee – 1.75% of gross salary – and employer – 4.75% of gross salary.

0 kommentar(er)

0 kommentar(er)